BRIC Manufacturing PMIs posted another sector-wide weakening in growth conditions in December, ending 2015 on foot of an outright contraction across the sector in all BRIC economies for the first time since late 2013.

Russian manufacturing PMI posted a deterioration in sector performance in December, falling to 48.7 from 50.1 in November. This reverses two consecutive months of above 50 readings in October and November. On a quarterly basis, 4Q 2015 average reading was 49.7, which is better than 48.4 average for 3Q 2015, but still below 50.0 line. Overall December reading was the weakest since August 2015 and signals that the much anticipated stabilisation of the Russian economy did not take place in December. More detailed analysis of Russian PMIs is available here for monthly data and here for quarterly data. Overall, Russia was the third weakest PMI performer in Manufacturing sector terms within the BRIC group.

Brazil’s Manufacturing PMI remained deeply below 50.0 mark in December, although rising to 45.6 from 43.8 in November. December reading stands as the highest in 3 months, but still signals sharp rate of activity contraction. 4Q 2015 average is at 44.5, which is down on 46.7 average for 3Q 2015. Brazil has now posted Manufacturing PMI readings below 50.0 for 11 months in a row, the longest such record in the group of BRIC countries. In addition, Brazil remained the weakest performer in terms of Manufacturing PMIs in the BRIC group.

Per Markit: “Brazilian manufacturing companies reported worsening operating conditions at the end of 2015. December saw output and new orders dip at rates that, although slower, remained sharp…Amid evidence of cashflow problems, stocks of purchases and post-production inventories both decreased at rates that were the quickest in over six years. …severe downturn in the sector that was evident among the three monitored market groups: consumer, intermediate and investment goods. …December data pointed to a further decline in incoming new work, the eleventh in as many months. …Panellists indicated that a deeper economic retreat and falling purchasing power among consumers had led domestic demand to dwindle. Conversely, new orders from abroad rose. The weaker real had reportedly supported firms in securing new business from external clients. That said, the overall pace of expansion was only marginal.”

China Manufacturing PMI fell from 48.6 in November to 48.2 in October, marking 10th consecutive month of sub-50 readings and the weakest reading in 3 months. On a quarterly basis, 4Q 2015 reading was 48.4 which is somewhat better than 47.4 reading for 3Q 2015, although still signifying overall contraction in the sector. By all metrics, Chinese Manufacturing PMI came in second weakest in the BRIC grouping after Brazil.

Per Markit: “Operating conditions faced by Chinese goods producers continued to deteriorate in December. Production declined for the seventh time in the past eight months, driven in part by a further fall in total new work. Data suggested that client demand was weak both at home and abroad, with new export business falling for the first time in three months in December. As a result, manufacturers continued to trim their staff numbers and reduce their purchasing activity in line with lower production requirements. Meanwhile, deflationary pressures persisted, as highlighted by further marked declines in both input costs and selling prices.” Overall, this was the first time exports orders fell since September 2015.

India Manufacturing PMI posted a moderate drop from 50.3 in November to 49.1 in December, putting PMI reading below 50.0 line for the first time since June 2015. However, on a quarterly average basis, 4Q 2015 came in at 50.0, signalling zero growth in the sector over the last quarter of 2015, down from relatively robust growth posted in 3Q 2015 (with PMI averaging 52.1). PMI averaged 51.7 in 2Q 2015. The data confirms my previously expressed view that India is now skirting dangerously close to a manufacturing recession and that overall economic growth conditions in the economy have deteriorated significantly compared to 2014.

Per Markit: “Indian manufacturers saw business conditions deteriorate at the end of 2015. December’s incessant rainfall in Chennai impacted heavily on the sector, with falling new work leading companies to scale back output at the sharpest pace since February 2009. On the price front, inflation rates of both input costs and output charges were at seven month highs. …Consumer goods bucked the sub-sector trend and was the only category to see improving business conditions in December as production and new orders rose. Conversely, incoming new work and output fell in both the intermediate and investment goods market groups. Having risen for 25 straight months, total

manufacturing production in India fell during December. Furthermore, the rate of contraction was the sharpest in almost seven years.”

Summary table:

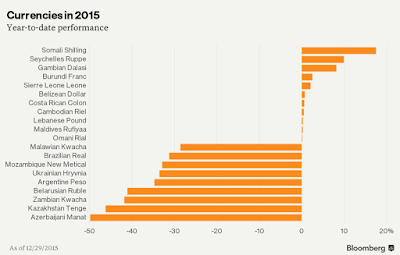

And a chart to illustrate

Hence, overall, as of December,

- Brazil manufacturing PMI continued to move along the general downward trend that started around 1Q 2013 and runs unabated since then, with Manufacturing recession setting in firmly from 2Q 2015 on.

- China, having displaced Russia for the second weakest position in the BRIC economies in terms of Manufacturing PMIs back in July 2015 remains the second weakest link in the BRIC group. Chinese manufacturing has been posting negative trend in PMIs since mid 2014, although in the last 3 months of 2015 this trend somewhat improved.

- Meanwhile, Russian Manufacturing is once again taking on water, having reverted down from a positive sub-trend that was present over May-November 2015.

- Last, but not least, the bright star of India is now fading in terms of Manufacturing PMIs, with both trend (downward since December 2014 and more pronounced downward trend since July 2015) and absolute level of PMI reading signalling a risk of manufacturing sector recession in India.

Overall, we now have all BRIC Manufacturing PMIs below 50 line for the first time since March 2009. This strongly shows overall continued downward pressures on growth in world’s largest emerging markets.